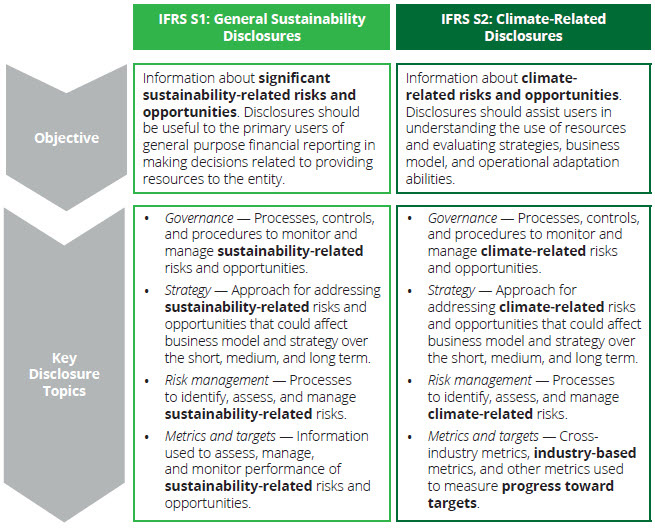

The IFRS S1 standard encourages companies to articulate the sustainability-related risks and opportunities they anticipate in the short, medium, and long term. This information is crucial for investors as it directly influences their decision-making process. The IFRS S2 standard focuses on specific climate-related disclosures and is designed to be used in conjunction with IFRS S1. Both standards are rooted in the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

Companies are required to disclose their sustainability-related financial information concurrently with their financial statements. These disclosures should encompass the same reporting period as the related financial statements. Starting from 1 January 2024, any company preparing a financial report should adhere to the IFRS 1 & 2 Standard for annual reporting periods. This means that the sustainability-related financial disclosures should be included in the same document that presents the company’s financial information.

The ISSB is actively seeking feedback on future priorities, with a consultation period open until September 1, 2023.

Please refer to Floodlight’s IFRS 1 & 2: A Comprehensive Guide For Disclosure for a more complete overview of disclosure requirements.

Now, let’s delve into ten key aspects of the ISSB’s new standards that you should be aware of:

- Global Baseline for Sustainability Disclosures: The ISSB Standards provide a universal baseline for sustainability disclosures in the capital markets, allowing for additional jurisdictional requirements to be layered on top.

- Wide International Support for ISSB Standards The ISSB’s work has garnered widespread support from various stakeholders worldwide, including the International Organization of Securities Commissions (IOSCO), the Financial Stability Board, the G20, and the G7 Leaders.

- Materiality Focus: The ISSB Standards focus exclusively on capital markets, requiring only information that is material, proportionate, and useful to investors. Starting with climate allows companies to gradually incorporate their sustainability disclosures.

- Consolidation of Existing Sustainability Initiatives: The IFRS S1 and S2 standards consolidate recommendations from TCFD, SASB Standards, CDSB Framework, Integrated Reporting Framework, and World Economic Forum metrics, streamlining sustainability disclosures.

- Enhanced Comparability, Reduced Reporting Redundancy: The baseline approach ensures global comparability for financial markets and allows jurisdictions to develop additional requirements if needed, reducing duplicative reporting for companies subject to multiple jurisdictional requirements.

- Effective Global Communication of Sustainability: The ISSB Standards are designed to provide reliable information to investors, helping companies communicate their sustainability-related risks and opportunities effectively.

- Alignment with Financial Statements: The ISSB Standards are designed to be provided alongside financial statements as part of the same reporting package. They are built on the concepts underpinning IFRS Accounting Standards, which are already required for use by more than 140 jurisdictions.

- Inclusive Development Process for ISSB Standards: The ISSB Standards were developed using the same inclusive, transparent process used to develop IFRS Accounting Standards, with over 1,400 responses to the ISSB’s proposals.

- Interoperability with GRI Standards: The ISSB’s partnership with the Global Reporting Initiative ensures that the ISSB requirements are interoperable with GRI standards, reducing the disclosure burden for companies using both ISSB and GRI Standards for reporting.

- Capacity-Building Partnership for Consistent Reporting: The ISSB announced plans for a capacity-building partnership program at COP27, aiming to establish the necessary resources for high-quality, consistent reporting across developed and emerging economies.