Key Takeaways

- Investors require accurate and accessible information to maximize returns and positive impact, effectively manage risk, and meet regulatory obligations. Today’s incumbent ESG data providers do not provide this.

- The majority of ESG data products deliver unhelpful composite scores, coarse estimates, or company-reported figures. They are built on black-boxed methodologies, rely on subjectively selected and estimated indicators, and marked with significant potential biases. Investors are often left to reverse engineer already costly data to get the information they need, resulting in even greater uncertainty.

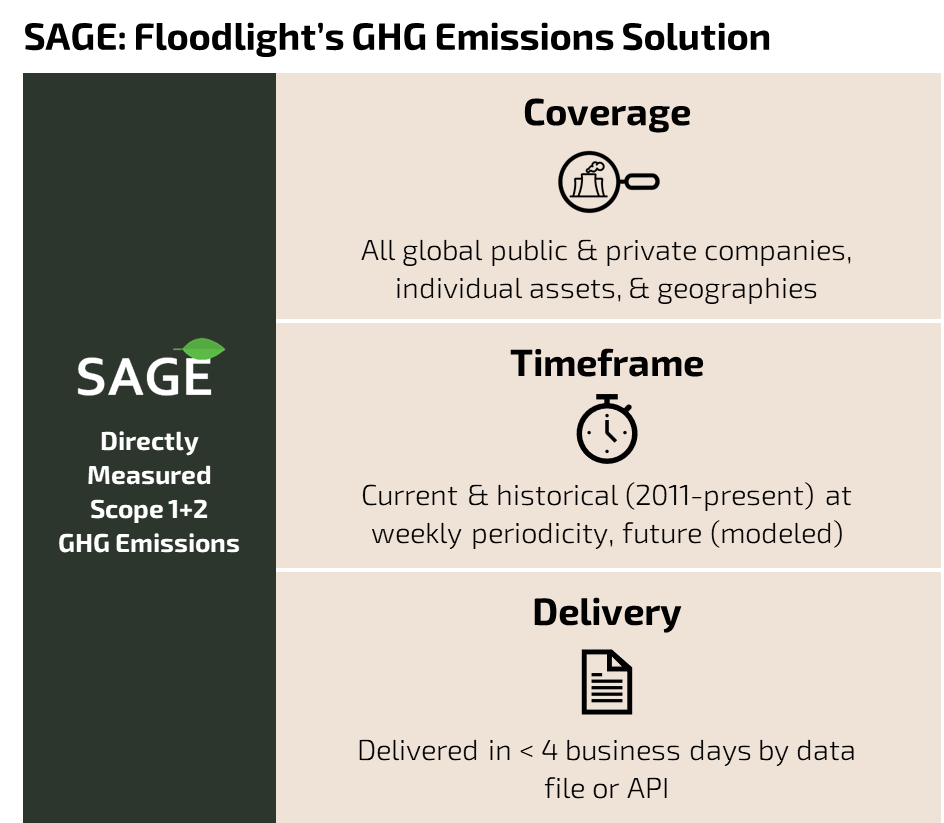

- Floodlight offers a solution to the ESG data problem. We directly measure sustainability impacts with satellites, sensors, and other verified sources, and validate our data with our peer-reviewed data science methods. As a result, we deliver ESG data that is fit for investing.

Paradigm shifting innovations that change our world for the better are precious and few. Opportunities to bring them to market are even scarcer. And so, when I was presented with one this spring, I made a career-altering decision to look beyond finance and join a start-up that is revolutionizing how we understand sustainability – Floodlight. It was an easy choice.

Floodlight’s technology introduces the ability to directly measure the sustainability impacts and risks of any company on Earth, at every point they do business. We use a range of verified sources, including satellites and remote-sensors, to measure with pinpoint accuracy, and we validate our data with methods developed over 20 years of peer-reviewed data science research by our co-founder, Dr. Suchi Gopal. Whereas almost all of today’s corporate sustainability datasets are coarse estimates or company-reported figures, our data reflects the exact impacts of day-to-day business operations. And unlike other sustainability data, which report on a lag, have coverage gaps, and cost a fortune, we measure our data in real time and use technology that enables global coverage and affordable pricing.

Our philosophy is simple – all business activities have quantifiable sustainability impacts, just as they have associated revenues and costs. Any limitations in gauging these impacts are related to approach, not impossibility.

In my new role, I lead Floodlight’s asset management segment and am developing sustainability measurement solutions for portfolios, investment vehicles and strategies, corporate engagement, and research. There is one key principle guiding our work – investors require accurate and accessible information to make prudent investment decisions that affect positive change. Today’s incumbent ESG data providers do not give them this. Just 38% of ESG investment teams reported high trust in ESG ratings providers in 2022 and 53% relied on in-house research for ESG information, 12% more than in 2019.1 I experienced challenges with ESG data firsthand while developing and researching sustainability and climate investments at asset management firms. Here is what I observed:

- Unhelpful Data: Most ESG scores are comprised of subjectively selected and weighted underlying indicators that are standardized to get to a composite. To provide a simplified example, a company’s environmental score would be calculated by taking indicators like estimated GHG emissions, forestry loss, soil pollution, and others the data provider deems relevant; standardizing data for each on a common scale; and weighting them according to industry-level proprietary models. These scores end up being far removed from the sustainability issues they seek to report on and can be drastically different across providers, leaving investors with more questions than answers.

- Unclear Methods: The methodologies underl ying a significant share of ESG data are overcomplicated and/or black-boxed, meaning that key methodology points needed to fulfill obligations to end-clients and regulators are considered too proprietary to share details around. Understanding what the data is truly showing can be an impossible task, presenting significant issues for sustainability reporting or investment decision-making when dollars and reputations are on the line. Investors should never have to reverse engineer the data they purchased for the information they need, let alone face brick walls when they have to do so anyway.

- Limited Accuracy & Potential Biases: Major ESG data products offer limited accuracy and are marked with potential biases. There are multiple angles to this. The use of estimates and company-reported figures in these products naturally introduce uncertainty and bias. These characteristics compound when the same estimates and company disclosures become interdependent inputs to each other, as can be the case; when data is adjusted to generate composites; and as investors reverse engineer them to get the data they need.

In my view, leading data providers do not deliver ESG data with the objectivity and accuracy needed to maximize returns, mitigate risk, and affect positive change. The global financial system is at a turning point. Achieving net-zero is a key priority for policymakers, as well as existentially minded companies and people around the world. Legislation like the EU Sustainable Finance Disclosure Regulation (SFDR) and rules proposed by the SEC puts the onus of this on financial institutions, while other regulations are penalizing companies for their negative sustainability impacts. At the same time, shareholders, employees, and communities are applying increasing pressure on companies to consider and report on their sustainability impacts and risks. But beyond just focusing on how companies impact people and the planet, these stakeholders are increasingly linking corporate sustainability to long term financial returns.

From my perspective, stakeholders can only address these issues when they are equipped with data that reports on sustainability in unquestionable terms. Floodlight’s scientific and technology-based approach addresses this need, providing data with incomparable accuracy, objectivity, and usefulness. This is why I joined Floodlight.

Andrew Little | SVP of Asset Management at Floodlight | Chartered Sustainable, Responsible, & Impact Investing Counselor

Reference(s):

1. The Sustainability Institute, “Rate the Raters,” 2020-2023.