Key Takeaways

- SLLs present a creative, accessible approach to sustainable finance that rewards borrowers with favorable terms for achieving material sustainability goals.

- To receive the benefits of their SLL, borrowers must regularly report on preset sustainability key performance indicators and targets, providing external verification of their performance.

- Floodlight offers a range of SLL-ready solutions, including KPI monitoring, reporting, and verification, as well as benchmarks to help set realistic performance targets.

The Sustainability-Linked Loan Floodgates are Open

Sustainability-Linked Loans (SLLs) are debt instruments structured to reward borrowers with favorable pricing, contingent on their ability to achieve preset sustainability goals. First introduced in 2017, SLLs are gaining significant traction among corporates and financial institutions, primarily due to their ability to unlock capital for a wide range of borrowers, while providing financial impetus to adopt more sustainable business practices. Speaking to this, global SLL issuance totaled $330 billion in 2022, more than 146x the $2.3 billion issued in 2017.1,2 And telling of their increasingly important role in global financing, there are more than $1 trillion of SLLs currently outstanding.3

The Why & How of SLLs

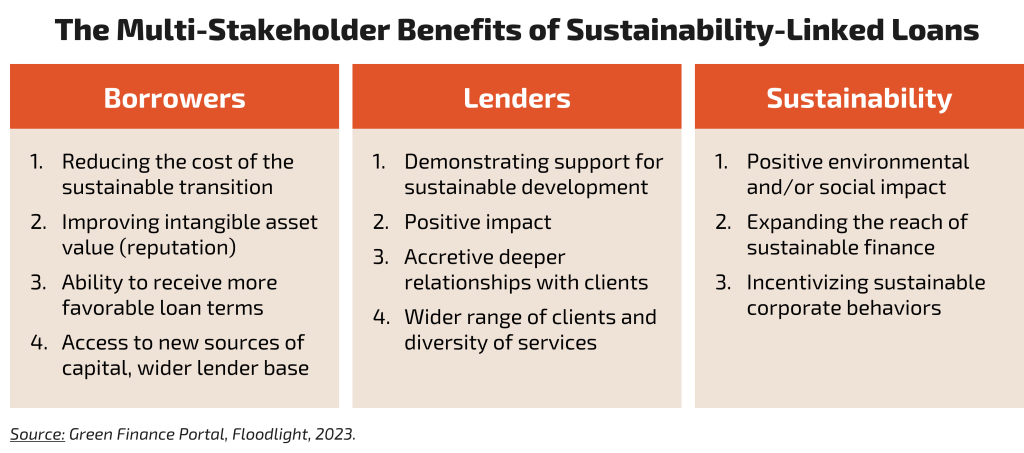

SLLs present a creative, more inclusive approach to sustainable finance. While traditional sustainability-oriented instruments like green bonds are an effective means of driving positive change, they require borrowers to use debt proceeds to fund specific projects. This characteristic limits the pool of borrowers to those who can address sustainability challenges in their regular course of business – clean energy companies, for example. SLLs, on the other hand, are agnostic to how proceeds are used. They provide capital to companies on the basis of their overall sustainability performance, rather than the sustainability or impact of specific projects.

How do SLLs work? SLLs are incentive-driven debt instruments that tie borrowers’ cost of capital to sustainability goals. Similar to how adherence to covenants can impact the terms of traditional debt, performance against sustainability goals inform the favorability of an SLL’s terms to a borrower. Or in other words, SLLs lower interest rates when borrowers achieve their goals – often by as much as 20 basis points – and increase rates when they do not.4

The goals underlying SLLs are always preset. Prior to the issuance of the loan, borrowers must work with lenders to establish key performance indicators (KPIs) and corresponding sustainability performance targets (SPTs) that quantify their goals and ability to achieve them over time. To date, the most common SLL indicators and targets are related to GHG emissions, though factors like recycling, energy efficiency, clean energy use, and biodiversity are also frequently tracked.5

Borrowers typically report on their KPIs and SPTs on an annual basis. As a part of this exercise, borrowers must obtain independent and external verification of their performance against each target and indicator for the reported-on period. Accepted verification methods include review by auditors, environmental consultant, or independent rating agencies, though the best practice is to receive an auditor’s reasonable assurance. Following the completion of reporting and verification, lenders evaluate borrowers performance against the terms of the SLL and adjust pricing accordingly.

The Floodlight Advantage

Floodlight offers a range of solutions that augment lenders’ SLL capabilities and provide borrowers with the tools needed to get the most out of their sustainable debt. Using satellites, other scientific instruments, and AI-driven data science, we measure the full gamut of sustainability impacts at the asset level, from GHG emissions and air pollution to biodiversity impact and hazardous waste. Beyond providing powerful tools for reporting and verification – our methods deliver reasonable assurance – our extensive global coverage allows us to offer sector- and industry-specific benchmarks stakeholders can use to set realistic SLL performance targets.

References:

1. Institute of International Finance, “Sustainable Debt Monitor,” Jan 2023.

2. ECGI, “Who Benefits from Sustainability-linked Loans?,” May 2023.

3. Institute of International Finance.

4. Real Estate Capital Europe, “Debt advisers see a growing role for ESG,” Sep 2021.

5. Environmental Finance Data, “Sustainability-linked bonds and loans – KPIs,” 2022.