Key Takeaways

- Climate scenario modeling is an essential risk management tool for identifying and optimizing around financially material acute and chronic climate-related risks

- Managing risk is an critical function for insurance companies and doing so prudently will increasingly require consideration of climate-related risks.

- Climate scenario modeling solutions are essential tools insurers can use to inform pricing, long-term strategic planning, product development, regulatory disclosure, and investment processes.

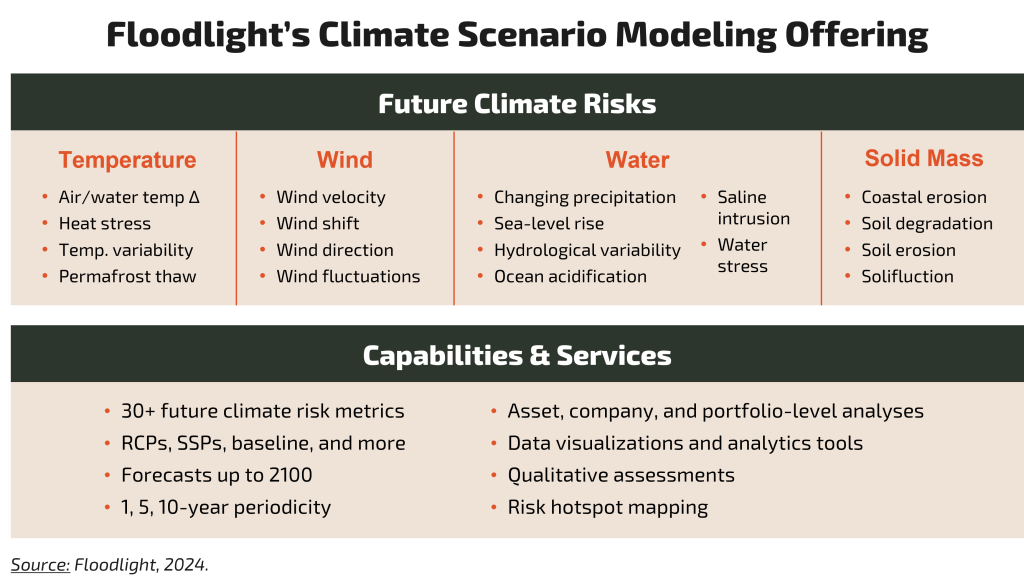

- Floodlight’s climate modeling offering leverages cutting-edge technology and techniques to quantify future climate risks across the full gamut of asset, company, portfolio, and geography-specific use cases.

Climate Scenario Modeling 101

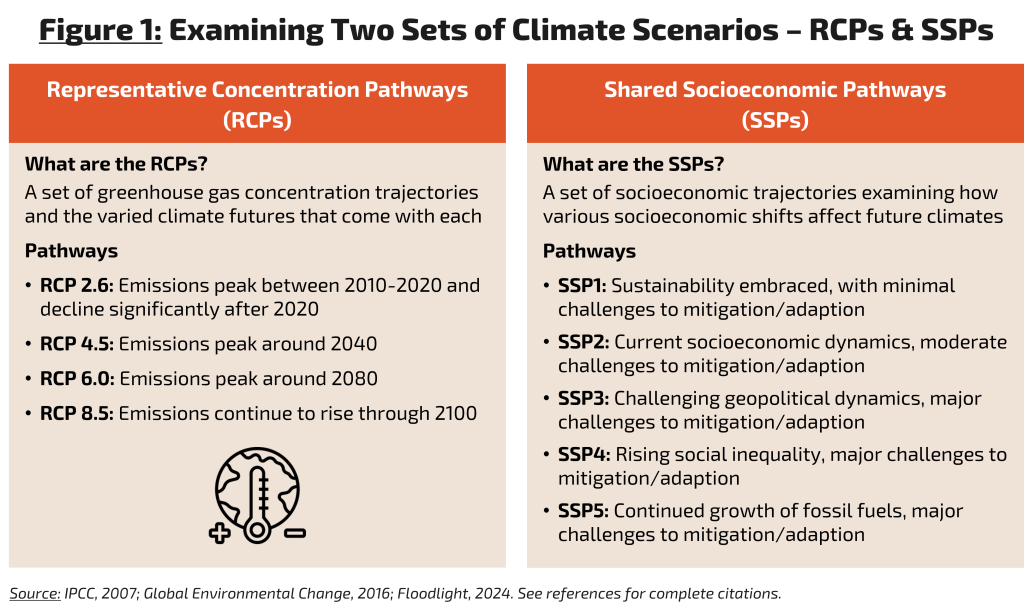

Climate scenario modeling offers a means of predicting changes in our planet’s climate over time and understanding the risks and realities that come with such changes. Climate scenarios, or potential future states of the climate determined by the intensity of change-inducing activities, are an essential component of this, enabling a contrasting view of varying degrees of future climate-related risks (see figure 1).

With Earth’s climate at an inflection point – atmospheric concentrations of CO2 are 50% higher than the level maintained for the 6,000 years prior to industrialization and global temperatures are 1.1 ⁰C warmer than in 1850 – climate scenario modeling is far more than a scientific exercise.1,2 It is a critical risk management tool for companies, governments, and investors looking to prudently orient themselves for the future.

Industry in Focus: Insurance

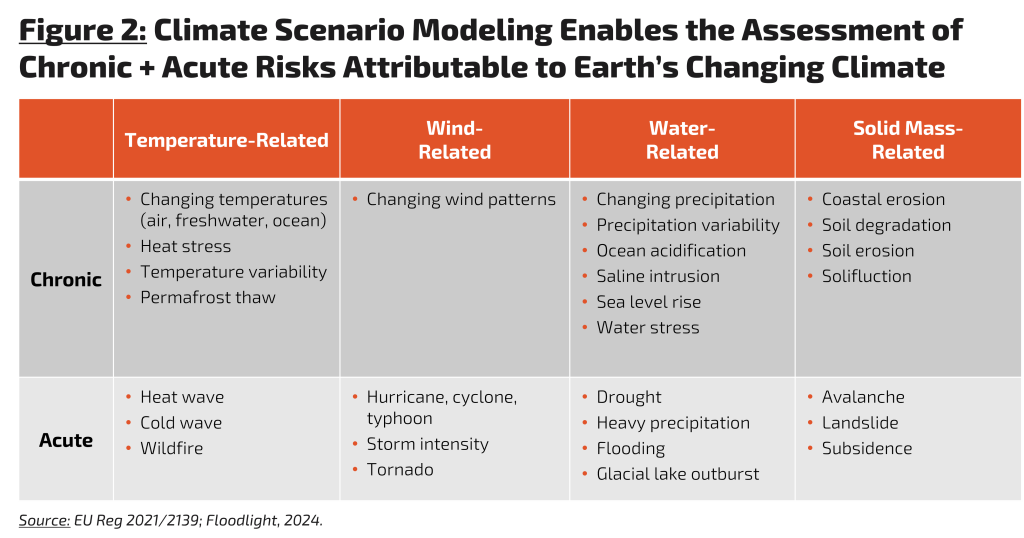

Insurance companies excel at identifying risks and their situational materiality. The ability to do so effectively is among the most important internal functions at an insurance firm, guiding underwriting processes, pricing strategies, and overall risk management. As the risk landscape evolves, insurers must adapt in lockstep – their success is contingent on their ability to be nimble, incorporating new material risks in their risk assessment models and evaluating the weight they apply to existing ones. So, with the ongoing and accelerating changes to Earth’s climate catalyzing an unprecedented introduction of new material risks (see figure 2), insurers must adapt as they always do. In a climate-centric risk landscape, climate scenario modeling is an essential tool that allows them to do so.

In the following, we explore key climate scenario modeling use cases for the insurance industry:

Pricing Insurance Products: Predictive data on the expected frequency and intensity of climate-related events (see figure 2) are crucial inputs for estimating potential losses and adjusting premiums to be commensurate with the level of risk. Or in other words, insurers need to be certain that the revenue they capture from premiums, and potentially other sources, more than make up for losses which could be incurred from paying out policies due to climate-related events.

Long-Term Strategic Planning: Most of the negative impacts which would arise from continued changes in Earth’s climate are years and, in many cases, decades away from materializing. Yet, prudent risk management entails anticipating what has yet to happen, even more so than what is happening currently. As insurers revisit and adjust long term plans for their businesses and internal operations, they can harness insights gained from climate scenario modeling to ensure liquidity for covering catastrophic climate event-related claims, optimize their offerings, and inform which products should be marketed to certain regions.

Product Development: Climate-related negative impacts will only become more tangible as time passes, introducing new pain points for asset owners and consumers which could be addressed by novel insurance products. Through this lens, climate modeling outputs can serve as leading demand indicators. Insurers can use this information to guide product development, giving insurers who employ climate models a competitive edge in capturing future revenue streams and maintain a relevant product lineup.

Regulatory Compliance and Reporting: Legislative bodies around the world are enacting new regulations that require the disclosure of material climate-related impacts and risks, many of which require climate scenario modeling to adequately assess. The financial services sector, in particular, is subject to the EU’s Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy Regulation. With insurers’ investments most recently representing between 20-30% of all global invested assets, the ability to identify and quantify is an imperative function for the industries regulatory compliance.

Investment Strategies: Wildfires, hurricanes, floods – each of these events and many others cause destruction and necessitate capital expenditures to repair the ensuing damage to affected assets. Following this thread, the financial materiality of climate-related risks is unquestionable. Insurers, as noted, are among the largest global investor cohorts, investing premiums in the financial markets to generate returns. They are risk-averse investors and maintain conservative asset allocations to complement their liabilities, or outstanding policies. As climate-related risks mount, it is incumbent upon insurance companies to assess their exposure to them and optimize portfolios to fall within its intended risk band.

Floodlight’s Climate Scenario Modeling Capabilities

At Floodlight, we are at the forefront of equipping private and public sector stakeholders with the tools needed to understand and mitigate exposure to climate-related risks. Our climate scenario modeling solutions are built on the foundational work of the Intergovernmental Panel on Climate Change (IPCC) and our team’s own 30+ years of peer-reviewed academic research. By leveraging sensor-equipped scientific instruments, verified alternative data sources, and in-house machine learning models, we can identify and quantify future climate risks for the full gamut of asset, company, portfolio, and geography-specific use cases.

References:

1. NOAA, “Trends in Atmospheric Carbon Dioxide,” accessed January 2024.

2. IPCC, “AR6 Climate Change 2021: The Physical Science Bias,” 2021.

RCPs/SSPs Graphic:

- Moss, Babiker, et al. “Towards New Scenarios for Analysis of Emissions, Climate Change, Impacts, and Response

Strategies.” Intergovernmental Panel on Climate Change. - SSPs Graphic: Riahi, Keywan, et al. “The Shared Socioeconomic Pathways and their energy, land

use, and greenhouse gas emissions implications: An overview.” Global environmental change.